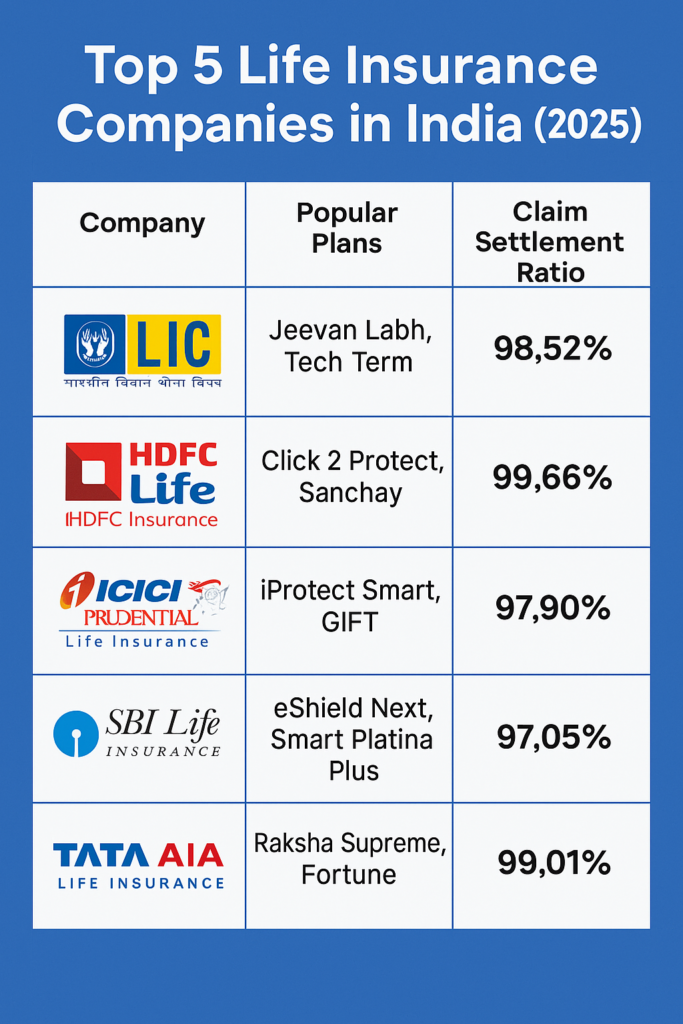

Top 5 Life Insurance Companies in India (2025)

In a rapidly changing world, securing your family’s financial future has never been more important. That’s where life insurance in India becomes a critical tool. Whether you’re looking for term life insurance, endowment plans, or ULIPs (Unit Linked Insurance Plans), choosing the best life insurance company can make a significant difference in your financial planning.

In this guide, we compare the top 5 life insurance companies in India in 2025, their most popular plans, claim settlement ratios, and unique features to help you make an informed choice.

🏆 1. Life Insurance Corporation of India (LIC)

🌟 Why LIC is Trusted:

LIC is India’s oldest and most trusted life insurer, with over 250 million policyholders. It consistently records a high claim settlement ratio and offers a variety of life insurance plans with guaranteed returns.

🔍 Popular Plans:

LIC Jeevan Labh (Limited premium, high return)

LIC Tech Term (Online-only term insurance)

📈 Key Features:

Government-backed security

Claim settlement ratio: 98.52%

Plans with maturity benefits and bonus additions

Ideal for long-term savings and life cover

🏆 2. HDFC Life Insurance

🌟 Why Choose HDFC Life:

HDFC Life combines digital efficiency with powerful life insurance solutions. They offer competitive premiums, online policy issuance, and a wide range of riders.

🔍 Popular Plans:

HDFC Click 2 Protect Life (Flexible term insurance)

Sanchay Plus (Guaranteed return endowment plan)

📈 Key Features:

High claim settlement ratio: 99.66%

Critical illness and waiver of premium add-ons

Quick online purchase & policy issuance

Tax savings under Section 80C & 10(10D)

🏆 3. ICICI Prudential Life Insurance

🌟 Why ICICI Pru Life Stands Out:

Backed by ICICI Bank, this company is known for its innovative term and investment-linked plans. It offers flexible premium payment terms and robust online support.

🔍 Popular Plans:

iProtect Smart (Term insurance with 34 critical illness coverage)

Guaranteed Income for Tomorrow (GIFT)

📈 Key Features:

Claim settlement ratio: 97.90%

Multiple payout options: lump sum, income, or combination

Waiver of premium on disability or illness

High credibility and performance consistency

🏆 4. SBI Life Insurance

🌟 Why Choose SBI Life:

SBI Life, a joint venture with BNP Paribas, delivers affordable life insurance solutions with wide accessibility across urban and rural areas.

🔍 Popular Plans:

SBI Life eShield Next (Smart term plan with rising cover)

Smart Platina Plus (Guaranteed income plan)

📈 Key Features:

Claim settlement ratio: 97.05%

Coverage for salaried & self-employed individuals

Premium waiver and income benefit riders

Online premium calculators and quick comparisons

🏆 5. Tata AIA Life Insurance

🌟 Why Tata AIA is Gaining Popularity:

A joint venture between Tata Sons and AIA Group, it combines the trust of Tata with global insurance expertise. Their plans are value-driven and digitally accessible.

🔍 Popular Plans:

Tata AIA Sampoorna Raksha Supreme

Fortune Guarantee Plus (Guaranteed income)

📈 Key Features:

Claim settlement ratio: 99.01%

No medical tests for some age groups

High sum assured options at low premiums

Attractive for young professionals and families

📊 Quick Comparison Table

| Company | Popular Plan | Claim Settlement Ratio | Unique Feature |

|---|---|---|---|

| LIC | Jeevan Labh, Tech Term | 98.52% | Government-backed, bonus returns |

| HDFC Life | Click 2 Protect, Sanchay | 99.66% | Customizable, high digital support |

| ICICI Prudential | iProtect Smart, GIFT | 97.90% | Covers critical illness & disability |

| SBI Life | eShield Next, Platina Plus | 97.05% | Affordable & accessible |

| Tata AIA | Raksha Supreme, Fortune | 99.01% | High sum assured, modern riders |

💡 Tips to Choose the Best Life Insurance Plan in India

Compare premiums online before buying

Look at the claim settlement ratio of the insurer

Opt for plans with critical illness or accidental death riders

Make sure the policy offers flexible premium payment options

Check if there are tax benefits under Sections 80C & 10(10D)

🎯 Final Words

Choosing the right life insurance policy in India ensures financial stability for your family, tax savings, and peace of mind. The five companies listed above offer reliable, high-return life insurance plans suitable for all age groups and income brackets.

👉 Whether you’re a salaried employee, business owner, or freelancer—compare, customize, and buy life insurance online today to secure tomorrow.